Important note: It is well past the period spanning the end of May and beginning of June when Bilderberg meetings are ordinarily scheduled, so it should be observed that the home page of the official Bilderberg website still declares in bold capitals:

THE MEETING 2020 IS POSTPONED.

It does not say for how long.

This is the fifth of a sequence of articles based around the ‘key topics’ at last year’s Bilderberg conference discussed here in relation to the prevailing political agenda and placed within the immediate historical context.

This piece focuses on issues relating to the European project:

A schematically enhanced version of last year’s ‘key topics’

*

Class interests and the ‘democracy deficit’

“The European Union doesn’t suffer or the Eurogroup from a democratic deficit. It’s like saying that we are on the moon and there is an oxygen deficit. There is no oxygen deficit on the moon. There is no oxygen, full stop.”

— Yanis Varoufakis 1

“The EU is the denial of democracy, the idea that there is a domain – the economy – that stands above popular sovereignty. This is the doctrine of ordoliberalism, as if the economy were not first and foremost a social relation, as if we – the workers’ movement and our historical traditions – had not been born by creating trade unions to change it…

“I want a Europe that proposes the language of freedom, equality and brotherhood to everyone, and which speaks a universal language to all peoples – a good wage, a good welfare system, a good education”.

— Jean-Luc Mélenchon 2

*

Europe’s nations should be guided towards the super-state without their people understanding what is happening. This can be accomplished by successive steps each disguised as having an economic purpose, but which will eventually and irreversibly lead to federation.

In fact, these weren’t [founding father of EU, Jean] Monnet’s words at all – but those of the Conservative politician and author, Adrian Hilton, in The Principality and Power of Europe, published in 1997. Yet this is almost by the by. That so many have ascribed the quote to Monnet is because so many have been so shocked at what the European project has since become.

The ECSC [European Coal and Steel Community] morphed first into the Common Market, then the EEC. Britain joined in 1973, and its public approved membership by two to one in the 1975 referendum: where recently elected Tory leader, Mrs Thatcher, campaigned passionately for a ‘Yes’ vote. But what the public were sold then – a mutually beneficial club based on free trade and nothing more – was not remotely what would transpire; and gradually, the penny began to drop.

This is an excerpt from an extended article by political commentator Shaun Lawson that was published shortly after the 2015 General Election. Looking forward to the prospect of Cameron’s promised EU referendum, he wishes to, as he puts it, “challenge[s] my fellow travellers on the left to do what they have so often neglected: to scrutinise the EU’s very many failings, think long and hard, and ask yourselves: is staying in really worth it?”

In the piece Lawson goes into close detail about how the European project has been steadily manoeuvred from free trade area towards full political union, reminding us that consolidation has happened absent not merely democratic scrutiny but in utter disregard to overwhelming popular dissent. The British electorate was never permitted any vote on the European Constitution and when other nations rejected it, the EU simply changed the title of the treaty and proceeded:

[I]n places where referenda were held – in France, the Netherlands, or (twice) in Ireland – rejections of the Nice Treaty, European Constitution, or Lisbon Treaty were met with studied indifference on the part of EU leaders. Their project was now such a runaway express train that no mere member state could be allowed to derail it; so the Constitution was turned into the Lisbon Treaty, and when the Irish people – the only national electorate anywhere in the EU to be allowed a vote on the most far-reaching, seismic piece of legislation in its history – vetoed this, they were simply asked to vote again. Democracy? What democracy?

Why was Lisbon so important? In amending and consolidating the Treaties of Rome and Maastricht, it:

- Moved the Council of Ministers from requiring unanimous agreement to qualified majority voting in at least 45 areas of policy

- Brought in a ‘double majority’ system: which necessitates the support of at least 55% of European Council members, who must also represent at least 65% of EU citizens, in almost all areas of policy

- Established a more powerful European Parliament, which would now forms part of a bicameral legislature along with the Council of Ministers

- Granted a legal personality to the EU, enabling it to agree treaties in its own name

- Created a new long term President of the European Council and a High Representative for Foreign and Security Policy

- And made the Charter of Fundamental Rights, the EU’s bill of rights, legally binding.

Whether you agree with these changes or not is beside the point. The point is: the peoples of Europe were never given a vote on it. Instead, all this was just pushed through over the European public’s collective head. In the twenty-first century, how can such profound constitutional changes – which impact on all Europeans, whether they realise it or not – be allowed without democratic consent?

Lawson continues:

In any polity, if leaders or legislators do not accede to their position through the ballot box, this lack of accountability breeds out-of-touch, unanswerable governance about which the public can do nothing. Yet that is the reality of the European Union. The President of the Commission is approved by the Parliament; except this happens unopposed. All Commissioners – who together, comprise the executive of the EU – are nominated by member states.

The President of the European Council – that is to say, the de facto President of Europe, the EU’s principal representative on the global stage – is chosen by the heads of government of the member states. And even the European Parliament, whose members are all directly elected by the public, (1) has overseen constant falling turnout ever since the first elections in 1979 (of below 50% at each of the last four European elections, and a miserable 42.5% in 2014); (2) cannot formally initiate legislation; (3) does not contain a formal opposition.

In terms of genuine democracy, most of the above is unrecognisable. If more and more people believe that powers are shifting away from their hands and national legislatures towards a group of illegitimate, unelected bureaucrats and apparatchiks, that’s probably because they’re right. 3

Click here to read the full article written by Shaun Lawson and published in September 2015 by OpenDemocracy.

*

Bilderberg and the European project

“For Bilderberg, as for Goldman Sachs, the idea that there might be any kind of push-back against globalisation is a horrific one.” — Charlie Skelton 4

In the days immediately prior to the EU referendum, Bilderberg reconvened in Dresden and topping their agenda was the discussion of potential repercussions. As Charlie Skelton reported:

The Bilderberg Group has been nurturing the EU to life since the 1950s, and now they see their creation under dire threat.

“A disaster for everyone” is how Henri de Castries [Chairman of the Bilderberg Steering Committee], the boss of AXA and a director of HSBC, describes Brexit. But in particular, it is a disaster for his banking and big business colleagues at Bilderberg. Thomas Enders, the CEO of Airbus, who [also] sits on Bilderberg’s steering committee – the group’s governing body – said, in a recent interview with CNBC, that his industry would be “lobbying” against Brexit.

Enders said: “Long-term it would not be positive certainly for the industry. This why the aerospace industry – I think amongst others – will lobby… for a [Remain] vote of the British electorate on the EU.” 5

Concluding:

An integrated EU, with the City at its centre, is a key building block in a globalised world, and its potential loss is a huge concern for “the high priests of globalisation”, as Will Hutton called the members of Bilderberg. The prospect of Brexit “frightens me”, admit Ken Jacobs, the head of Lazard, and another member of Bilderberg’s inner circle. Not much frightens these people. Only two things: sunlight and Brexit.

Click here to read his full report published by the International Business Times.

Charlie Skelton was interviewed by Jason Bermas on the eve of last year’s conference:

“I spoke a few years ago to a former very senior official at the European Commission… this was around the time of the Greece collapse, you know, I said ‘What happens if Greece leaves the EU?’ And she was like ‘It doesn’t really matter’. I said ‘Well what if Britain leaves the EU?’ And she went ‘Oh, it would be catastrophic.’” — Charlie Skelton [from 10:20 mins]

*

Kingmakers of the EU

One month on following last summer’s Bilderberg confab, European leaders were required to put forward nominations for the EU’s top jobs. BBC News reported on the new appointments describing them only as ‘surprising’ before going on to highlight and praise the positive gender balance, as if this is somehow a sign of the EU’s overall tip towards greater equality:

The surprise choice of German Defence Minister Ursula von der Leyen to replace Jean-Claude Juncker came after the main front-runners were rejected.

IMF chief Christine Lagarde has been nominated as the first woman to head the European Central Bank (ECB). 6

What the BBC completely fails to mention is that, of the four nominees, three have been long-standing Bilderberg affiliates. Nominated as President of European Commission, Von der Leyen, the unpopular German Defence Minister (since December 2013), had been a Bilderberg regular since at least 2016 (Dresden), returning in 2018 (Turin) and also featuring in the 2019 list of participants. [please note: no reference to any attendance at Bilderberg is provided by her Wikipedia entry]

In step with predecessor Jean-Claude Juncker, Von der Leyen is a vocal advocate for a future “United States of Europe”, and again like Juncker, she has been quite clear about the need for a fully-integrated European defence union:

Jean-Claude Juncker told the ‘Welt am Sonntag’ Sunday paper that forming an EU army would be one of the best ways for the bloc to defend its values, as well as its borders. […]

Defense Minister Ursula von der Leyen said last month, for instance, that a form of EU army should be a long-term goal for the block. Von der Leyen said that she was convinced about the goal of a combined military force, just as she was convinced that “perhaps not my children, but then my grandchildren will experience a United States of Europe.” 7

Von der Leyen was eventually confirmed as the European Council’s choice on July 16th. Emmanuel Macron, one of the keenest proponents of her appointment, is well-known for his outspoken criticism of the rise of nationalism and yet, as Serge Halimi has pointed out, when it finally came to the confirmatory vote at the European Parliament later the same day:

In the end, Von der Leyen was elected president with a majority of only nine votes, by a coalition including 13 Hungarian MEPs with allegiance to Orbán and 14 Italian populists from the Five Star Movement (M5S), then allies of Salvini. 8

Click here to read Serge Halimi’s full article entitled “The EU’s Ursula von der Leyen: Who Voted for Her?”

Note that: Francois Fischer, Head of the Intelligence Analysis Division, European Union Intelligence and Situation Centre, has been candid in his view that irrespective of Brexit, the UK will continue to be bound in European military alliance:

“First of all, in the security and intelligence sector, the UK will not leave…. it may be a secret, but you will not leave.”

Meanwhile, current head of the IMF, Christine Lagarde, who oversaw the imposition of crippling austerity measures on Greece and the other ‘PIIGS’ in response to the so-called ‘debt crisis’, was newly nominated to head the European Central Bank. For the record, Lagarde attended Bilderberg in 2013 (Watford), 2014 (Copenhagen), 2016, (Dresden) and 2017 (Chantilly) all during her tenure as Managing Director of the IMF [Wikipedia only references her participation in 2013]

Lastly, ex-Prime Minister of Belgium, Charles Michel, the newly selected President of the European Council is another frequent guest at Bilderberg. He was invited as Belgium PM in 2015 (Telfs-Buchen) and 2016 (Dresden), and also attended last year’s meeting in Turin. [once again, there is no reference at all to Michel’s Bilderberg attendance on Wikipedia]

As Charlie Skelton chides: “It’s a good day for women… it’s an even better day for Bilderberg.”

Click here to read more of my thoughts on the relationship between Bilderberg and its sister event at Davos, the World Economic Forum (WEF).

*

List of western leaders previously groomed by Bilderberg:

Gerald Ford attended Bilderberg 1964, 1966 appointed as US President 1974

Margaret Thatcher attended Bilderberg (at least 1975, 1977, 1986) became Prime Minister 1979

Bill Clinton attended Bilderberg 1991 became US President 1993

Tony Blair attended Bilderberg 1993 became Prime Minister 1997

Paul Martin attended Bilderberg 1996 became Prime Minister of Canada 2003

Stephen Harper attended Bilderberg 2003 became Prime Minister of Canada 2006

Angela Merkel attended Bilderberg 2005 became Chancellor of Germany (Nov) 2005

Emmanuel Macron attended Bilderberg 2014 became President 2017 9

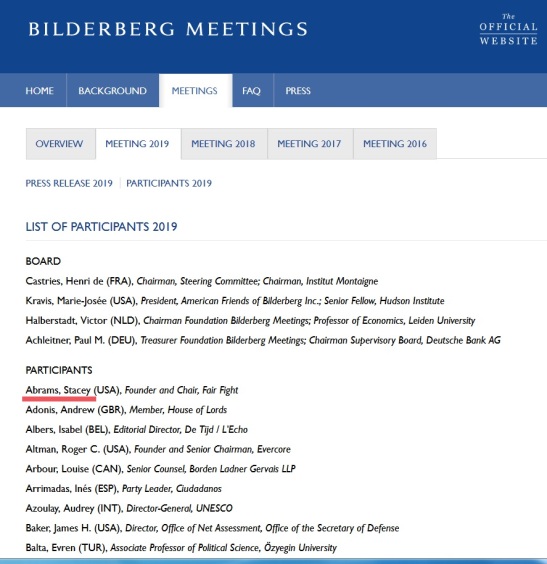

Note that: If Stacey Abrams is picked as Joe Biden’s running mate then that’s another one bagged by Bilderberg who invited Ms Abrams to last year’s meeting in Montreux. Add her name to the roll call above.

Screenshot of BB official website list of participants at last year’s event with Stacey Abrams listed top

*

A European Army?

Although the question of the formation of a European Army is repeatedly dismissed as “just a conspiracy theory”, the title of this section is drawn verbatim from the subheading of a recent Royal United Services Institute (RUSI) Workshop Report. The report in question offers a résumé of its half-day workshop in collaboration with the Friedrich-Ebert-Stiftung (FES) after they had “brought together leading UK and German parliamentarians with leading security and defence experts from both countries to discuss the most salient threats to European security.”

The paragraph beneath “A European Army?” reads as follows [with footnote retained]:

The subject of a European army dominated much of the open discussion. While it is a topic that received passing mentions in previous RUSI–FES engagements, 10 the concept received greater explanation from Bundestag members present, and scrutiny both from UK MPs and subject experts.

With the goal of achieving ‘strategic autonomy’ for Europe, some participants suggested that European states should look to form a joint command structure that would allow the EU to deploy forces both within and beyond Europe’s borders. It was strongly suggested that the US can no longer be regarded as a ‘reliable partner’ and that Europe ought to take responsibility for its own defence mechanisms. Additionally, at present European states do not believe that there are any democratic means to hold NATO accountable. Any actions taken by a European army would be subject to the checks and balances of the European Parliament and thus under the scrunity [sic] of elected representatives. 11

The meeting in question proceeded under Chatham House Rules and the names of participants including those of our “leading UK and German parliamentarians” are not disclosed, so we are left in the dark in this regard. Returning to the text, however, and the passage that most rings alarm bells is surely this:

… some participants suggested that European states should look to form a joint command structure that would allow the EU to deploy forces both within and beyond Europe’s borders.

The response to the Yellow Vests protests has been the recent deployment of French troops on the streets of Paris, whereas the Catalan Independentists have been faced with Guardia Civil forces moved in from Madrid. Suppose instead that troops could be moved in from say Hungary or Poland, somewhere the military personal have no national allegiance to the protesters; how much more brutal might the subsequent crackdown have been?

Arguably the greatest single threat posed by the formation of “a European Army” is that it could enable a deployment of troops within Europe’s borders, and yet found within a document released by one of Europe’s most influential think tanks – “the world’s oldest independent think tank on international defence and security” as it describes itself – is just such a proposal.

*

Additional: The snubbing of Václav Klaus

In the same article quoted at the beginning, Shaun Lawson also reminds us of the disdain the EU has shown to elected European leaders, citing the example of Václav Klaus, then President of the Czech Republic:

In December 2008, Klaus met with the leaders of various European Parliamentary groups at Hradcany Castle, overlooking Prague. His country had yet to sign the Lisbon Treaty. You might imagine this would have been a convivial meeting, with full respect shown towards a democratically elected head of state. Quite the reverse.

Daniel Cohn-Bendit, leader of the European Greens, complained bitterly that the EU flag was not in evidence above the castle, and plonked his own flag down on the table. He then informed the Czech President: “I don’t care about your opinions on the Lisbon Treaty”.

After the appalling Hans-Gert Pöttering, President of the EU Parliament, weighed in on Cohn-Bendit’s behalf, it was the turn of the Irish MEP, Brian Crowley: who fulminated against Klaus’ apparent support of the successful ‘No’ campaign in the recent referendum. When Klaus replied: “The biggest insult to the Irish people is not to accept the result”, Crowley bawled: “You will not tell me what the Irish think. As an Irishman, I know it best.”

If this was bad, it would get worse. Far worse. Two months later, Klaus was invited to speak to the European Parliament as head of a member state. Europe’s MEPs – supposed servants of the people – were clearly very unused to being told anything other than how wonderful and important they all were. Instead of engaging in the standard empty platitudes, Klaus took the opportunity to deliver perhaps the most important speech ever made in the continental legislature:

Are you really convinced that every time you vote, you are deciding something that must be decided here in this hall and not closer to the citizens, ie. in the individual European states?… In a normal parliamentary system, a faction of MPs supports the government and a faction supports the opposition. In the European Parliament, this arrangement is missing. Here, only one single alternative is being promoted and those who dare think differently are labelled as enemies of European integration.

As if to prove Klaus right, jeers and whistles now began to ring out around the chamber. Undeterred, the President continued, reminding his audience of his country’s tragic recent history under Communist rule: “A political system that permitted no alternatives and therefore also no parliamentary opposition… where there is no opposition, there is no freedom. That is why political alternatives must exist”.

At length, Klaus arrived at the coup de grace. In a few softly spoken paragraphs, he not only punctured the pomposity of the delegates as no-one ever had before; he also set out exactly what was wrong with the European Union, and why this fundamental problem could not be resolved:

The relationship between a citizen of a member state and a representative of the Union is not a standard relationship between a voter and a politician, representing him or her. There is also a great distance (not only in a geographical sense) between citizen and Union representatives, which is much greater than it is inside the member countries.

Lawson adds:

Since there is no European demos – and no European nation – this defect cannot be solved by strengthening the role of the European Parliament either. This would, on the contrary, make the problem worse and lead to an even greater alienation between the citizens of the European countries and Union institutions.

This distance is often described as the democratic deficit; the loss of democratic accountability, the decision-making of the unelected – but selected – ones, the bureaucratisation of decision-making. The proposals… included in the rejected European Constitution or in the not much different Lisbon Treaty would make this defect even worse.

There followed a quite extraordinary spectacle. Unable to bear the laser guided truth missiles raining down upon them from the lectern, 200 MEPs rose to their feet and walked out. In a dispiriting sign of just how impervious the British left had become on the whole question of the EU, many of those doing so were Labour MEPs. As demonstrations of the farce that is European ‘democracy’ go, it will never be bettered. 12

Click here to read the full article by Shaun Lawson and published September 2015 by OpenDemocracy.

*

In fuller context [from 1hr 16:40 mins]:

Q: Hello. My question is for Mr. Chomsky. In the past you’ve been very critical of the way in which the West has engaged in political and economic imperialism around the world behind closed doors, kind of smoke and mirrors. How do you believe that transparency and democratizing the Eurozone—

NOAM CHOMSKY: And democratizing the Eurozone.

Q: How it will kind of affect or possibly deter this behavior?

NOAM CHOMSKY: Well, actually one of the things that Yanis discusses in his book is that the Eurozone—in the Eurozone, democracy has declined arguably even faster than it has in the United States. During this past generation of neoliberal policies there has been a global assault on democracy, that’s kind of inherent in the principles. And in the Eurozone it’s reached a remarkable level. I mean, even the Wall Street Journal, hardly a critical rag, [laughter] pointed out that no matter who gets elected in a European country, whether it’s communist, fascist, anybody else, the policies remain the same. And the reason is they’re all set in Brussels, by the bureaucracy, and the citizens of the national states have no role in this, and when they try to have a role, as in the Greek referendum, they get smashed down. That’s a rare step. Mostly they are sitting by passively as victims of policies over which they have nothing to say, and what Yanis said about the Eurogroup is quite striking. This is a completely unelected work group. Not in any remote way related to citizens’ decisions, but it’s basically making the decisions, the choices and decisions. That’s even beyond what happens here. Here it’s bad enough, but that’s more extreme.

YANIS VAROUFAKIS: Let me add to this just to clarify something. Actually I will go further than Noam about Europe. The European Union doesn’t suffer or the Eurogroup from a democratic deficit. It’s like saying that we are on the moon and there is an oxygen deficit. There is no oxygen deficit on the moon. There is no oxygen, full stop. [laughter] And this is official in Europe.

At my first Eurogroup, as the rookie around, I was given the floor to set out our policies and to introduce myself, which is nice, and I gave the most moderate speech that I thought it was humanly possible to make. I said, “I know that you are annoyed I’m here. Your favorite guy didn’t get elected, I got elected, I’m here, but I’m here in order to work with you, to find common ground, there is a failed program that you want to keep insisting on implementing in Greece, we have our mandate, let’s sit down and find common ground.” I thought that was a pretty moderate thing to say. They didn’t.

And then after me, after I had expounded the principle of continuity and the principle of democracy, and the idea of having some compromise between the two, Doctor Wolfgang Schäuble puts his name tag forward and demands the floor and he comes up with a magnificent statement, verbatim I’m going to give you what he said, “Elections cannot be allowed to change the economic policies of any country.” [laughter] At which point I intervened and said, “this is the greatest gift to the Communist Party of China, because they believe that too.” [laughter]

In reply to question during Q+A session following a discussion with Noam Chomsky at the New York Public Library on April 26, 2016. https://www.yanisvaroufakis.eu/2016/06/28/full-transcript-of-the-yanis-varoufakis-noam-chomsky-nypl-discussion/

2 From an interview with Jean-Luc Mélenchon conducted by David Broder for The Tribune, published under the title: “Everyone should know – I am very dangerous” [I am currently unable to find an upload of this piece]

3 From an article entitled “Just what is the point of the European Union?” written by Shaun Lawson, published in OpenDemocracy on September 16, 2015. https://www.opendemocracy.net/en/can-europe-make-it/just-what-is-point-of-european-union/

4 From an article entitled “Bilderberg 2016: We can expect desperate lobbying against Brexit from Big Business” written by Charlie Skelton, published in International Business Times on June 7, 2016. https://www.ibtimes.co.uk/bilderberg-2016-we-can-expect-desperate-lobbying-against-brexit-big-business-1563898

5 Ibid.

6 From an artile entitled “Germany’s Ursula von der Leyen nominated to lead EU Commission” published by BBC news on July 2, 2019. https://www.bbc.co.uk/news/world-europe-48847200

7 From an article entitled “Juncker calls for collective EU army” published by Deutsche Welle on March 8, 2015. https://www.dw.com/en/juncker-calls-for-collective-eu-army/a-18302459

8 From an article entitled “The EU’s Ursula von der Leyen: Who voted for her?” written by Serge Halimi, published in Counterpunch on September 5, 2019. https://www.counterpunch.org/2019/09/05/the-eus-ursula-von-der-leyen-who-voted-for-her/

9 All dates published by wikipedia. https://en.wikipedia.org/wiki/List_of_Bilderberg_participants#United_Kingdom

10 Sarah Lain, ‘RUSI–FES British–German Dialogue’, Workshop Report, RUSI and Friedrich-Ebert-Stiftung, 2015.

11 From the RUSI Workshop Report entitled “RUSI-FES British-German Dialogue on Defence and Security 2019” authored by Jeremy Wimble, published by RUSI in August 2019. https://rusi.org/sites/default/files/201908_cr_german_security_dialogue_final_web.pdf

12 From an article entitled “Just what is the point of the European Union?” written by Shaun Lawson, published in OpenDemocracy on September 16, 2015. https://www.opendemocracy.net/en/can-europe-make-it/just-what-is-point-of-european-union/